NEWS LINKS

[elementor-template id=”222″] THE SERVICES THE OPTIONS THE MARKETOUR LATEST EDITORIAL

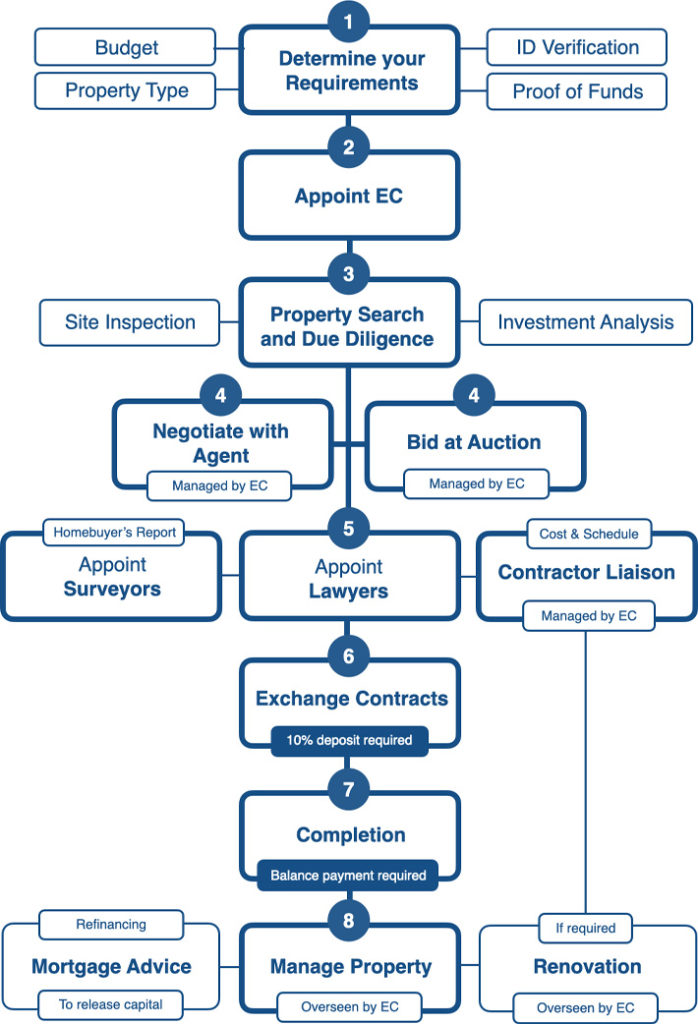

Your 8-Step investment guideWe make the process simpler

As an overseas investor, identifying and acquiring a UK property can be a complex, exhausting and costly task. We’re here to help.

A trusted way of working

Ellis Church delivers total transparency. No hidden costs, exaggerated ROI claims, or aggressive marketing. We charge a pre-determined fee. You remain in complete control.

A personalised approach

Long-term relationships, we realise, are built upon ensuring we consistently deliver the highest level of service and returns for our clients. Your success, after all, is ours too.

Step 1. Determine your requirements

In order for us to fulfill your goals, we first need to understand your objectives and investment criteria.

For example:

- What level of risk and reward are you comfortable with?

- What is your budget?

Many other factors require careful consideration when determining and proposing properties that may be suited to you.

This process enables EC to offer advice and recommendations as to what the most effective investment route would be for you.

Investment Types

A number of property investment models can be considered

- Retail HMOs

- UKGA HMOs

- Residential

- Commercial

- Land Developments

UK Buy to Let (BTL) properties are increasingly popular. As property prices continue to rise and affordable homes grow scarcer, rental demand intensifies.

‘Houses in Multiple Occupation’ (HMOs) are investment routes that cater to this growing, sustainable market sector

Getting to know you (KYC)

We like to plan, and prepare, ahead of time.

All property sellers, and their agents, require verification of your identity, address and proof of funds – in order to accept any offer.

In an environment where the best properties are highly sought after – having such information on hand often proves the difference between success and failure.

Step 2. Appoint Ellis Church

Once both parties are happy to move forward EC will prepare a formal agreement in order to begin working on your behalf.

This agreement will itemise the services we will provide and the properties we will seek, specific to your needs. The agreement will also present our cost schedules.

Upon confirmation, EC will immediately undertake a process of identifying and presenting potential properties for your review.

Step 3. Property Searches

EC identify potential properties through various channels; Estate agencies and online searches, property aggregators, Auction Houses, local authorities, UKGOV-appointed providers, direct approaches to owners.

Identifying a suitable property requires evaluating a whole range of market factors. Success or failure can even depend upon which street a property is located.

EC are able to provide essential on-the-ground knowledge, expertise and the connectivities needed in finding the right investment(s) for you.

Due Diligence & Presentation

Each property found requires physical site inspection, research of the immediate vicinity and surrounding areas, assessment as to its potential/feasibility, the costs associated with its acquisition and conversion.

EC presents its findings; detailing the property, site imagery, floor plans and overviews of the area.

Using its own proprietary property calculator, EC also presents a detailed financial ROI analyses – for both cash and mortgage models.

Step 4. Property Bidding

Should a particular property meet your investment criteria, EC will act on your behalf to secure a ‘purchasein-principle’ at the lowest possible price.

It’s important to note that any offers accepted by the seller carry no legal obligations on your part. Nor do they exclude the seller from accepting better offers elsewhere.

Properties acquired through Auction are considered final and require a 10% deposit with the balance typically payable within a 30 day period of a successful bid.

Step 5. Appoint Lawyers and Surveyors

Following a seller’s agreement to your offer, you are required to appoint a lawyer and surveyor to work on your behalf.

EC are happy to assist in sourcing such professional services if required.

EC will also use this ‘grace period’ to undertake a deeper study of the property, including seeking costs and schedules for any renovation work that may be required.

Step 6. Exchange Contracts

Assuming a property satisfies your, your lawyer’s and EC’s, requirements, both the seller and buyer will prepare and exchange contracts for review.

Typically a 10% non-refundable deposit will be required by the seller’s agent upon the exchange of these contracts.

You are, at this stage, advised to secure a building insurance policy.

At this point, you are committed to buying the property and the seller; legally obliged to sell the property.

Step 7. Contract completion

Upon formal signing of the contracts by both parties, the balance payment is typically required within 30 working days,

You now legally own the property

You will also be at liberty to formally appoint contractors for renovation work and appoint a leasing agent (if considered necessary for retail HMO properties). EC will act on your behalf to assist in all the above.

Step 8. Property Management

EC will continue to oversee and monitor the condition and performance of your property and, alert you to any remedial work that may be required.

Quarterly reports will be provided for your review.

EC can also assist in providing mortgage advice – a strategy we highly recommend in maximising your return on investment and releasing capital to, for example, further expand your property portfolio.

Capital Realisation

EC will also continue to keep you updated on any news, forecasts and opportunities specific to your property, its area and the UK market in general.

Should you wish to sell the property in future EC can provide you with the advice and services necessary in selling your property to its maximum potential.

SUBSCRIBE